Everyone knows the value buying local has on their community, but most people don’t realize how impactful banking local can be.

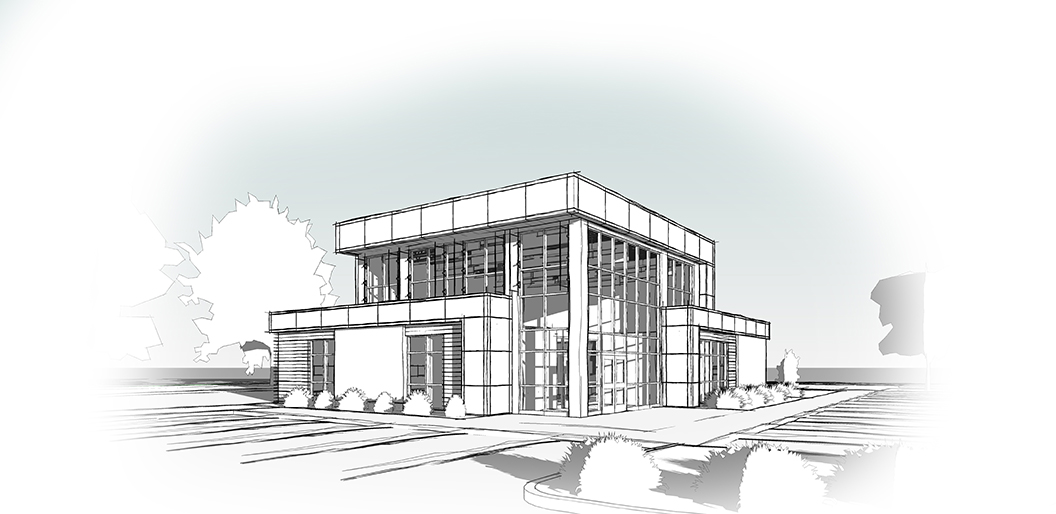

By Staywood Design, Photos courtesy of Staywood Design

We find ourselves in a time where the way we bank is changing. Fintech has made mobile transactions not only normalized but expected. Community banks and credit unions are being consumed by larger institutions, which has led to fewer banking choices for consumers and businesses. People are holding money in payment uninsured apps.

Dare we mention, savings and loan associations are long gone. If you were familiar with them in the first place, you might be wondering, “Oh yeah, where did they go?”

The banking industry landscape as we know it has completely changed. While convenience has vastly improved, how has that impacted our home turf? Simply put, it’s been hurt.

Ashton Brooks, co-owner of the architectural design-build firm Staywood Design, which specializes in building financial institutions, has had a ringside seat for the shift that’s taken place. “Earlier this year, I was at a ladies’ dinner. A discussion about the recent banking crisis came up,” Brooks says. “One woman balked and said, ‘Banks are just Ponzi schemes.’ My eyes got wide, and I was silently aghast. I thought, ‘Is this how some people view banks now?’ The headlines can be scary. I wondered if this sentiment was universal.”

Brooks and her brother, Staywood’s architect, grew up in a tight-knit community with a father who worked in management at a regional savings and loans that also used to develop subdivisions. “We literally grew up around construction and banking,” she muses. “It’s what we know. So when we started our business, we used our skills with the intentions of helping community institutions so other people could have the opportunities that our hometown afforded us.”

With her MBA, Brooks has used her business skills to structure her accounting practices to have less overhead compared to other architecture firms, allowing for savings to be passed on to her clients. “Most community institutions can’t afford a specialty design firm. But because of their unique security concerns, they need designers that understand the way they operate but also what threats they face. This is where we come in and fill the gaps. We want to serve them so they can serve their communities.”

Reflecting on the changing banking industry and the shifting sentiments, Brooks says, “The distrust in financial institutions that my friend expressed isn’t unfounded. Many people blame larger banks for their role in the financial crisis of the late 2000s. However, the most recent banking scare hit regional and community banks the hardest. Community banks and credit unions pride themselves on personal relationships and service excellence. These institutions play an important role in specialty lending for local industries such as agriculture, public agencies and not-for-profits.

These are industries that bigger institutions do not have the expertise, risk appetite or profit motivation to pursue. But these are the industries that make up communities across the country. We as Americans are also so lucky to have so many banking options. There are over 4,000 banking institutions in the U.S. Other major countries only have a few major banks to choose from. Canada, for instance, only has five.”

Beyond consumer sentiment, the local financial institution has it hard these days. Being tied to a specific community has caused slower growth. This in turn limits profitability, making them prime targets to be absorbed by larger institutions. “They aren’t typically as agile and don’t adjust to the shifting consumer standards quickly,” Brooks says.

“We have witnessed a significant shift in the way a branch location runs. It used to be that their lobbies were mostly for transactions; now they’re significantly retail based. They’re more focused on personalized relationships, products and services, which is a great benefit to the consumer. But it’s not cheap to remodel institutions to accommodate the change.”

Most consumers don’t realize the real impact that banking locally has. In contrast to larger financial institutions, the money you put into your community bank or credit union stays in your community. “In the simplest form, when you make a deposit, banks act as intermediaries and lend funds to those that need to take on a loan,” Brooks explains.

“The money you deposited is used for commercial loans, student loans, auto loans and mortgages. This is where your dollars can really make a difference. Your money can actually go to helping your neighbors buy a house. Can actually go to helping your friend start a business. Your money can help a family member get an education. Banking locally means your money stays within your community.”